一只股票经历的阶段

股票四个Understanding the Four Phases of Stock Trading

Stock trading is a dynamic journey characterized by fluctuating prices, investor sentiments, and market conditions. To navigate this terrain effectively, understanding the four distinct phases of stock trading is essential. These phases, often referred to as accumulation, markup, distribution, and markdown, provide a framework for analyzing price movements and making informed trading decisions.

1. Accumulation Phase:

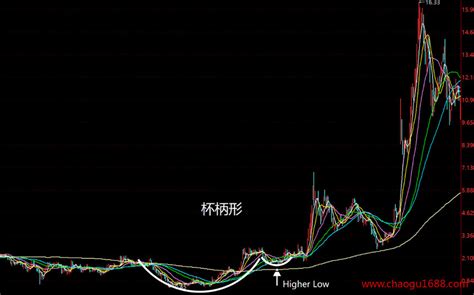

During the accumulation phase, savvy investors strategically accumulate shares of a stock while prices are relatively low. This phase typically occurs after a period of downtrend or consolidation when the stock is undervalued or overlooked by the broader market. Investors with a longterm perspective see potential in the stock's fundamentals and start accumulating positions.

Key Characteristics:

Prices stabilize or show signs of bottoming out.

Trading volume may increase slightly as interest starts to build.

Institutional investors and informed traders start accumulating shares discreetly.

Example:

Imagine Company X, a promising tech startup, has undergone a recent selloff due to market volatility. During the accumulation phase, institutional investors recognize the company's growth potential and start accumulating shares at discounted prices.2. Markup Phase:

As buying pressure builds during the accumulation phase, the stock enters the markup phase. This phase is characterized by a sustained uptrend as demand for the stock outweighs supply. Positive news catalysts, strong earnings reports, or strategic partnerships often fuel this upward momentum, attracting both retail and institutional investors.

Key Characteristics:

Prices steadily rise as demand increases.

Trading volume expands significantly as momentum traders join the trend.

Technical indicators such as moving averages and MACD confirm the bullish trend.

Example:

Following positive clinical trial results for a biotech company, its stock enters the markup phase as investors anticipate regulatory approval for its groundbreaking drug.3. Distribution Phase:

During the distribution phase, early investors who accumulated shares during the accumulation phase begin to sell their positions to realize profits. This phase is marked by a plateau or slight decline in prices as selling pressure balances out buying demand. Smart money investors and insiders gradually exit their positions, causing the uptrend to lose momentum.

Key Characteristics:

Prices fluctuate within a narrow range or show signs of topping out.

Trading volume decreases as selling pressure intensifies.

Technical indicators such as divergences or bearish reversal patterns signal a potential trend reversal.

Example:

After a prolonged uptrend, investors start to take profits on a retail免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052