北京理财产品排行

Title: Exploring Investment Opportunities in Beijing's Financial Products

Introduction:

With its status as the capital city of China and a global financial hub, Beijing offers a wide array of financial products and investment opportunities. As an investor, it is essential to understand the key aspects of Beijing's financial landscape and make informed decisions to maximize returns while managing risks. In this article, we will explore various types of financial products available in Beijing and provide guidance on how to choose the right investment options.

1. Bank Deposits and Savings Accounts:

One of the most straightforward and secure investment options is to open a bank account or deposit funds in a Beijing bank. Banks in the city offer competitive interest rates, providing a stable and predictable return on investment. This option is suitable for conservative investors who prioritize capital preservation and liquidity. However, it is important to note that the returns on bank deposits may be relatively low compared to other investment avenues.

2. Stock Market and Equities:

Beijing is home to the two major stock exchanges in China, namely the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE). Investors can participate in the stock market by buying shares of both domestic and international companies listed on these exchanges. Investing in equities requires thorough research, market analysis, and careful consideration of factors such as company performance, industry trends, and governmental policies. It is advisable for investors to seek professional advice or engage a reputable brokerage firm when participating in the stock market.

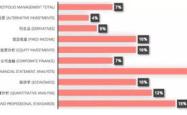

3. Mutual Funds:

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Beijing offers a wide variety of mutual funds managed by professional fund managers. These funds provide retail investors with access to a diversified investment portfolio and professional expertise. Before investing in mutual funds, investors should carefully review the fund's investment objectives, performance history, expense ratios, and risk profiles. It is crucial to select funds that align with personal investment goals, risk tolerance, and investment horizon.

4. Real Estate Investment:

Beijing's booming real estate market presents another investment avenue. Investors can choose to invest in residential or commercial properties, either directly or through real estate investment trusts (REITs). Real estate investments offer the potential for capital appreciation and rental income. However, it is essential to thoroughly research the market, consider location factors, and assess the longterm potential of the property. As with any investment, taking into account the associated risks, such as changes in government policies or market fluctuations, is crucial.

5. PeertoPeer Lending:

Peertopeer (P2P) lending platforms have gained prominence in recent years as an alternative investment option. These platforms connect investors with individuals or businesses seeking loans. Investors can lend money to borrowers in exchange for interest payments. P2P lending offers potentially higher returns than traditional bank deposits, but it also carries higher risks. Investors should carefully assess the reliability and credibility of the platform, diversify investments across multiple loans, and be prepared for potential defaults.

Conclusion:

Beijing offers a diverse range of financial products and investment opportunities to cater to various investment preferences and risk appetites. As an investor, it is crucial to conduct thorough research, seek professional advice, and critically evaluate each investment option based on individual investment goals, risk tolerance, and time horizon. Additionally, diversification across different asset classes is key to manage risk effectively. By adopting a balanced and informed approach, investors can navigate Beijing's financial landscape and potentially achieve their investment objectives.

免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052