希望的英文怎么说

Benefits of Mutual Funds

Introduction

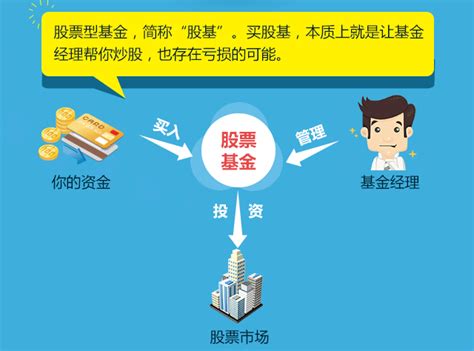

Investing in mutual funds can offer numerous advantages to individual investors. Mutual funds are investment vehicles that pool money from various investors to invest in a diversified portfolio of securities such as stocks, bonds, and other assets. Here are some key benefits of investing in mutual funds.

1. Professional Management

Mutual funds are managed by professional fund managers who have expertise in analyzing and selecting appropriate securities for the portfolio. These managers actively monitor the portfolio, make investment decisions, and adjust the holdings based on market conditions and investment objectives. Their knowledge and experience can potentially generate higher returns compared to individual investors managing their own portfolios.

2. Diversification

One of the primary benefits of mutual funds is their ability to provide diversification. By investing in a mutual fund, you gain access to a wide range of securities across different industries, sectors, and countries. This diversification helps spread the investment risk and reduces the impact of any one investment on your overall portfolio. Diversification is particularly crucial for investors who may not have the time or expertise to build and manage a welldiversified portfolio themselves.

3. Liquidity

Mutual funds offer a high level of liquidity, allowing investors to readily buy or sell their shares at the end of each trading day. Unlike some other investments like real estate or individual stocks, mutual funds can be easily converted into cash, providing investors with flexibility and access to their funds as needed. This feature is particularly important for investors who may require quick access to their money in case of emergencies or other financial needs.

4. Affordability

Most mutual funds have relatively low minimum investment requirements, allowing investors to start with small amounts of money. This makes mutual funds accessible to a wide range of investors who may not have substantial capital to invest directly in individual stocks or other investment options. Additionally, mutual funds may offer the advantage of costefficient trading due to economies of scale. As the fund pool grows, transaction costs for buying and selling securities can be spread across a larger base, potentially reducing overall investment expenses.

5. Easy Portfolio Management

Investing in mutual funds simplifies portfolio management for individual investors. Instead of tracking and managing multiple individual securities, investors can consolidate their investments into a single mutual fund. This makes it easier to monitor performance, review asset allocation, and make necessary adjustments to the portfolio based on investment goals, risk tolerance, and market conditions. Mutual funds also provide regular reporting and updates, making it simpler to track the performance and value of investments.

Conclusion

Investing in mutual funds can offer several benefits, including professional management, diversification, liquidity, affordability, and easy portfolio management. As with any investment, it is important to carefully evaluate and select mutual funds based on your investment objectives, risk tolerance, and financial goals. Consulting with a financial advisor can help you choose mutual funds that align with your needs and provide a suitable investment strategy. Remember to review the fund's prospectus, fees, and historical performance before making any investment decisions.

免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052