理财平台2021

Title: Understanding Financial Management Platforms

In today's digital age, financial management platforms have become indispensable tools for individuals and businesses alike. These platforms offer a wide array of services, ranging from budgeting and expense tracking to investment management and retirement planning. Let's delve into the intricacies of financial management platforms and explore how they can benefit users across various aspects of personal and business finance.

Understanding Financial Management Platforms

Financial management platforms, also known as personal finance apps or tools, are software applications designed to help individuals and businesses manage their finances effectively. These platforms typically offer a range of features aimed at simplifying financial tasks and providing insights to make informed decisions.

Key Features of Financial Management Platforms

1.

Budgeting and Expense Tracking

: One of the fundamental features of these platforms is budgeting. Users can set budgets for different categories such as groceries, entertainment, and utilities. The platforms track expenses automatically, providing realtime updates on spending patterns. This feature enables users to identify areas where they may be overspending and make necessary adjustments.

2.

Goal Setting

: Many financial management platforms allow users to set financial goals, such as saving for a vacation, purchasing a home, or retiring comfortably. Users can track their progress toward these goals and adjust their financial strategies accordingly.3.

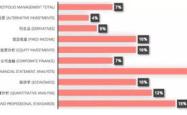

Investment Management

: Some platforms offer investment management tools that help users build and manage investment portfolios. These tools may provide insights into asset allocation, risk tolerance, and investment performance. Users can execute trades, monitor their investments, and receive alerts on market trends.4.

Debt Management

: Debt management features help users track and pay off debts efficiently. Users can see their outstanding balances, interest rates, and payment schedules in one place. Some platforms offer strategies for debt repayment, such as the debt snowball or debt avalanche method.5.

Financial Reporting and Analysis

: Financial management platforms often generate reports and analytics to help users gain insights into their financial health. These reports may include cash flow statements, net worth calculations, and spending trends. Users can visualize their financial data through charts and graphs, facilitating better decisionmaking.6.

Bill Payment and Reminders

: Many platforms offer bill payment features that allow users to schedule and pay bills directly from the app. Users can set up reminders for upcoming bills to avoid late payments and associated fees.Benefits of Using Financial Management Platforms

1.

Increased Financial Awareness

: By centralizing financial information and providing realtime updates, these platforms enhance users' awareness of their financial situation. Users gain a better understanding of their spending habits, saving patterns, and investment performance.2.

Efficiency and Convenience

: Financial management platforms streamline financial tasks, saving users time and effort. With features like automatic expense categorization and bill payment, users can manage their finances efficiently from a single interface.3.

Improved Financial Planning

: By setting goals, tracking progress, and receiving personalized recommendations, users can develop robust financial plans tailored to their objectives and circumstances. These platforms empower users to make informed decisions about saving, investing, and debt management.4.

Enhanced Security

: Leading financial management platforms prioritize data security and employ encryption and authentication measures to safeguard users' sensitive information. Users can rest assured that their financial data is protected against unauthorized access.5.

Access to Financial Education

: Many financial management platforms offer educational resources, articles, and tools to help users improve their financial literacy. Users can learn about topics such as budgeting, investing, and retirement planning, empowering them to make sound financial decisions.Considerations When Choosing a Financial Management Platform

1.

Features and Functionality

: Evaluate the features offered by different platforms and choose one that aligns with your financial goals and preferences. Consider whether you need basic budgeting tools or more advanced investment management capabilities.2.

Security Measures

: Prioritize platforms that implement robust security measures, such as encryption, multifactor authentication, and regular security audits. Ensure that your financial data remains secure and protected from cyber threats.3.

Cost and Fees

: Some financial management platforms are free to use, while others may charge subscription fees or transaction fees for certain services. Consider the cost implications and choose a platform that offers value for money based on your needs.4.

User Interface and Experience

: The user interface plays a crucial role in the usability of a financial management platform. Choose a platform with an intuitive interface and userfriendly design that makes navigation and task execution seamless.5.

Integration with Financial Institutions

: Ensure that the platform integrates seamlessly with your bank accounts, credit cards, and investment accounts. This integration enables automatic data syncing and provides a comprehensive view of your finances.Conclusion

Financial management platforms play a pivotal role in helping individuals and businesses manage their finances effectively. By offering a wide range of features such as budgeting, investment management, and debt tracking, these platforms empower users to take control of their financial lives. When choosing a financial management platform, consider factors such as features, security, cost, and user experience to find the solution that best suits your needs. With the right platform, you can achieve greater financial awareness, efficiency, and peace of mind.

This comprehensive guide outlines the significance of financial management platforms, elucidating their features, benefits, considerations, and selection criteria. Whether you're an individual seeking to optimize personal finances or a business aiming to streamline financial operations, leveraging a suitable financial management platform can facilitate better decisionmaking and financial wellbeing.

免责声明:本网站部分内容由用户上传,若侵犯您权益,请联系我们,谢谢!联系QQ:2760375052